Payroll calculator smartasset

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Discover ADP Payroll Benefits Insurance Time Talent HR More.

Best Places To Live On A 65 000 Salary 2022 Edition

Ad Process Payroll Faster Easier With ADP Payroll.

. Ad See the Paycheck Tools your competitors are already using - Start Now. Federal Paycheck Quick Facts. Well Do The Work For You.

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Taxpayers fall into one of four income brackets depending on.

Companies will withhold federal and FICA fees from your own paycheck. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local. Customized Payroll Solutions to Suit Your Needs.

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Every taxpayer in North Carolina will pay 525 of their taxable income for state taxes. A financial advisor in Virginia can help you understand how taxes fit into your overall financial goals.

Ad Process Payroll Faster Easier With ADP Payroll. Federal income tax rates range from 10 up to a top marginal rate of 37. Ad CareCom Homepay Can Handle Your Household Payroll And Nanny Tax Obligations.

Medicare and Social protection fees together constitute FICA fees. Well Do The Work For You. 45 with regard to Medicare.

Hourly Salary - SmartAsset 2022. The end result is the FICA taxes you pay out are still just 6. Here When it Matters Most.

This standardized Editable Pay Check Stub. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Like most states Virginia also collects a state income tax.

Your employer withholds a 62 Social Security tax and a. Ad Compare This Years Top 5 Free Payroll Software. 2 with regard to Social Security plus 1.

Companies withhold 145percent in. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local. We provide several paycheck stub calculator templates that can make immediate pay stubs ready for you to download and use right away.

Read reviews on the premier Paycheck Tools in the industry. Get Started With ADP Payroll. Discover ADP Payroll Benefits Insurance Time Talent HR More.

Ad CareCom Homepay Can Handle Your Household Payroll And Nanny Tax Obligations. Financial advisors can also help with investing and financial plans including retirement. Your Details Done Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state.

When calculating your take-home pay the first thing to come out of your earnings are FICA taxes for Social Security and Medicare. To calculate your annual salary multiply the gross pay before taxes by the number of pay periods in the year. Household Payroll And Nanny Taxes Done Easy.

Get Started With ADP Payroll. Your Details Done Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local. Smartasset Paycheck Calculator Online 59 Off Www Ingeniovirtual Com Bagikan Artikel ini.

Free Unbiased Reviews Top Picks. For example if you earn 2000week your annual income is calculated by. North Carolina has not always had a flat income tax rate.

You will drop any money you put in above 500 unless you use. To calculate your annual salary multiply the gross pay before taxes by the number of. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

Ad Heartland Makes Payroll Easy with Margin-Friendly Pricing for Your Business. Household Payroll And Nanny Taxes Done Easy.

Gross Vs Net Income How Do They Differ Smartasset

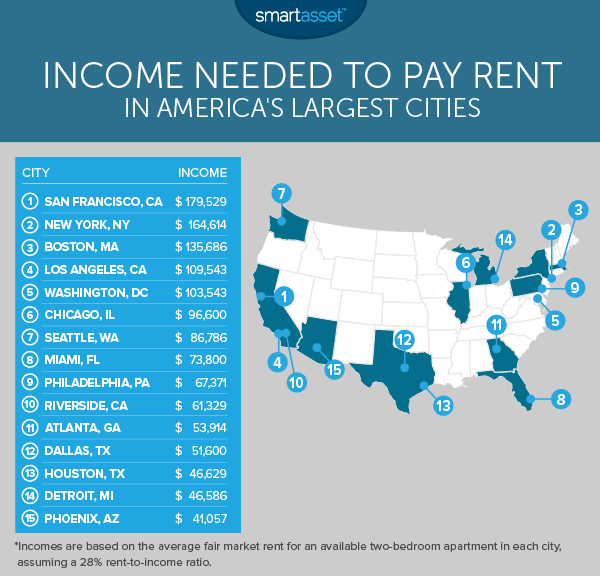

Income Needed To Pay Rent In The Largest U S Cities Smartasset

Payroll Tax Deductions Smartasset

Where Residents Are Most Likely To Pay State And Local Taxes Smartasset Paying Irvine Resident

Free Income Tax Calculators The Best In The Usa

Salary Needed To Live Comfortably In The 25 Largest Metro Areas 2022 Study

Lifestyle Comparison Calculator Altru Health System

Virginia Income Tax Calculator Smartasset Income Tax Income Tax Return Federal Income Tax

Vanguard Says Bonds Can Earn You Big Bucks What You Need To Know

Understanding Payroll Taxes And Who Pays Them Smartasset

Federal Income Tax Deadline In 2022 Smartasset

Idaho Retirement Tax Friendliness Retirement Calculator Financial Advisors Retirement

Income Needed To Pay Rent In The Largest U S Cities 2020 Edition

Should You Pay Attention To A Stock S Trading Volume Smartasset

New York Paycheck Calculator Smartasset

What It Takes To Be In The 1 By State 2022 Study Smartasset

Smartasset Paycheck Calc Selling 53 Off Santeweb Com