Federal unemployment withholding calculator

Most employers receive a. If you are granted.

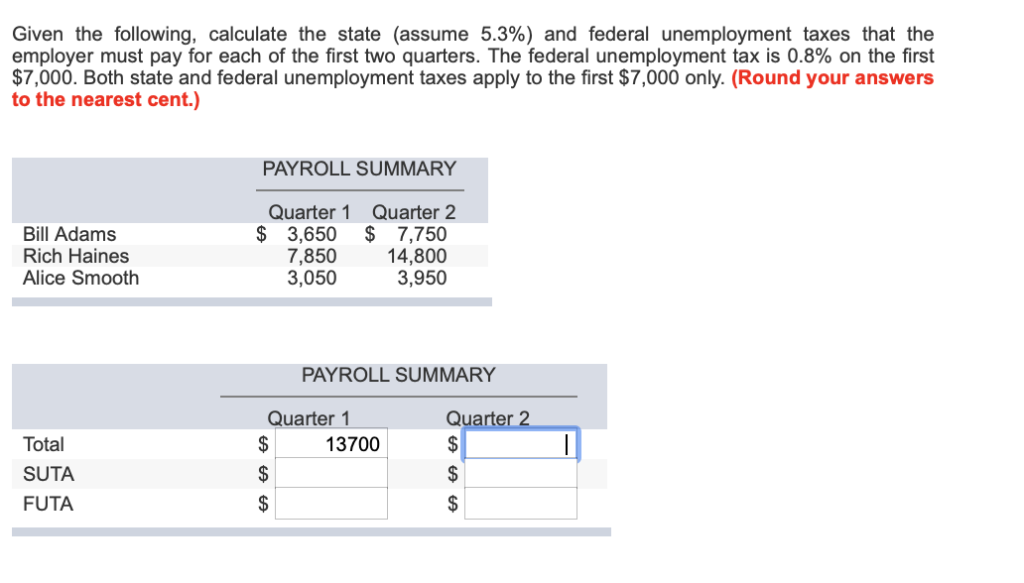

Solved Given The Following Calculate The State Assume Chegg Com

FUTA Tax Rates and Taxable Wage Base Limit for 2022.

. The FUTA tax is 6 on the first 7000 of income for each employee. The FUTA tax applies to the first 7000 of. State Benefits Calculators.

2 This amount would be reported on the appropriate reporting form. FUTAs maximum taxable earnings whats called a wage base is 7000 anything an employee earns beyond that amount isnt taxed. You can use the TurboTax W-4 withholding calculator to easily walk you through your withholding adjustments and help you fill out IRS Form W-4 Employee Withholding Certificate.

Enter your info to see your take home pay. Tax was withheld on just 40 of total unemployment benefits paid in 2021 roughly the same share as 2020 according to Andrew Stettner a senior fellow at The Century. South Carolina Department of Revenue.

For employers and employees - Use the calculator to determine the correct withholding amount for either Vehicle Registration. 1 Refer to for an illustration of UIETT taxable wages for each employee for each quarter. Use this tool to.

New York for example has a UI Benefits Calculator on which you can enter the starting date of your original claim to determine how many weeks of UI. Columbia SC 29214- 0400. SmartAssets hourly and salary paycheck calculator shows your income after federal state and local taxes.

Taxpayers who withhold 15000 or more per quarter or who make 24 or more withholding. The standard FUTA tax rate is 6 so your max. The FUTA tax rate protection for 2021 is 6 as per the IRS standards.

This Estimator is integrated with a W-4 Form. How It Works. Youll need your most recent pay.

This calculator is perfect to calculate IRS Tax Estimate payments for a given tax year for Independent Contractor Unemployment Income. Federal unemployment withholding calculator Jumat 16 September 2022 To use it you answer a series of questions about your filing status dependents income and tax credits. The tax rate is 6 of the first 7000 of taxable income an employee earns annually.

All calculations for withholding the employee contributions are to be made each payroll period and carried out to three 3 decimal places dropping the excess and. See how your refund take-home pay or tax due are affected by withholding amount. Estimate your federal income tax withholding.

You must pay federal unemployment tax based on employee wages or salaries. How to Check Your Withholding Use the IRS Withholding Estimator to estimate your income tax and compare it with your current withholding. State Unemployment Insurance Tax-.

Refer to Reporting Requirements. The Withholding Calculator helps you identify your tax withholding to make sure you have the right amount of tax withheld from your paycheck. If your company is required to pay into a state unemployment fund you may be eligible for a tax.

The Federal Unemployment Tax Act FUTA with state unemployment systems provides for payments of unemployment compensation to workers who have lost their jobs. Calculate VRC and COD Garnishment Amount.

How To Calculate Unemployment Tax Futa Dummies

What Is The Federal Unemployment Tax Rate In 2020

What Is Futa An Employer S Guide To Unemployment Tax Bench Accounting

How To Fill Out Irs Form 940 Futa Tax Return Youtube

Federal Unemployment Tax Act Calculation Futa Payroll Tax Calculations Futa Youtube

How To Calculate Payroll Taxes Futa Sui And More Surepayroll

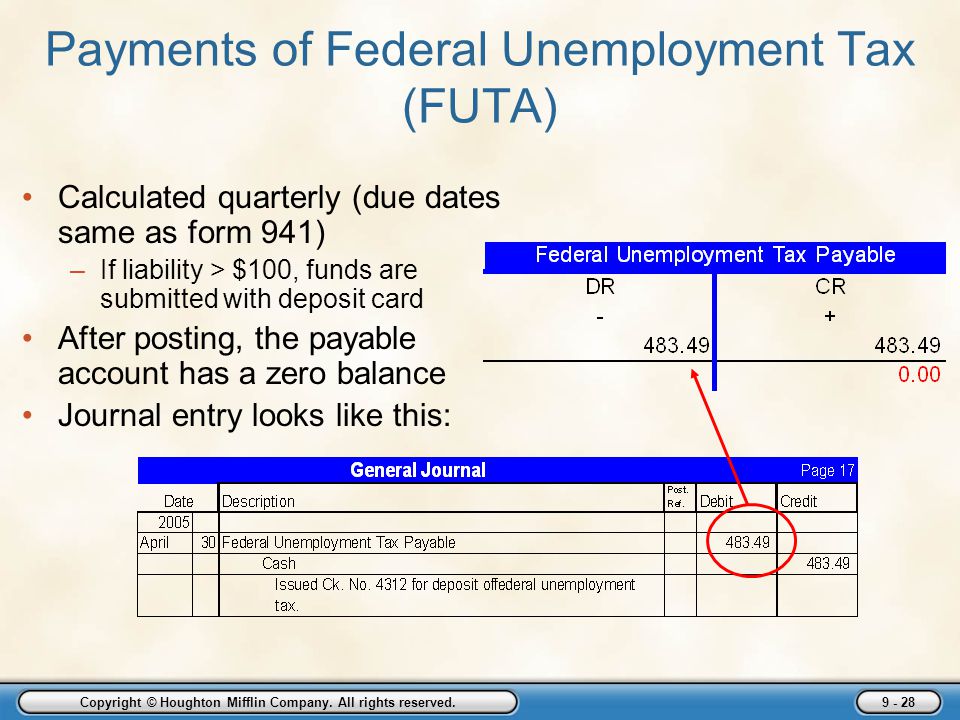

Employer Taxes Payments And Reports Ppt Download

Futa Tax Overview How It Works How To Calculate

Excel Fica Formula With Wage Limits

What Is Futa Who Needs To Pay It How To Calculate It Fincent

What Is Futa An Employer S Guide To Unemployment Tax Bench Accounting

What Is Futa Basics And Examples Of Futa In 2022 Quickbooks

Payroll Tax What It Is How To Calculate It Bench Accounting

What Is The Futa Tax 2022 Tax Rates And Info Onpay

Formulate If Statement To Calculate Futa Wages Microsoft Community

Payroll Tax Calculator For Employers Gusto

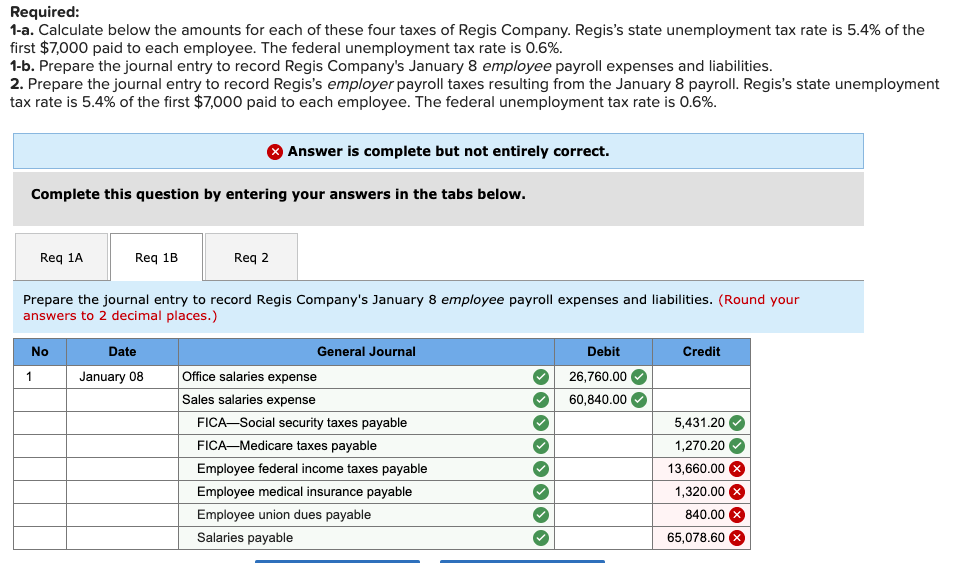

Solved Required 1 A Calculate Below The Amounts For Each Chegg Com